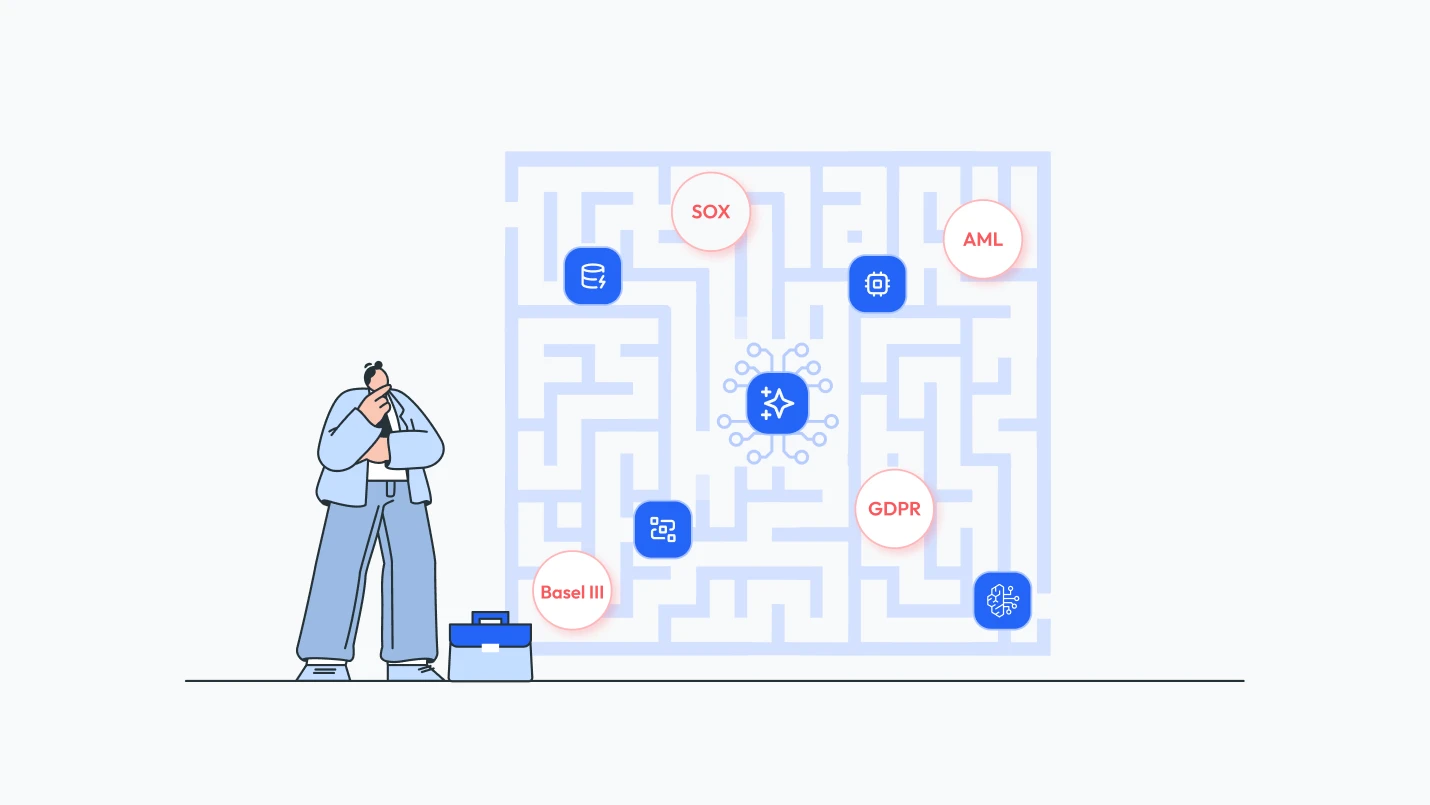

Compliance in financial services is more than a regulatory checkbox—it’s a high-stakes, ever-evolving challenge and feels like a maze most of the time. With mounting regulations like SOX, Basel III, GDPR, and AML, the pressure is intense. Non-compliance can cost millions, tarnish reputations, and disrupt operations. In fact, some banks have seen compliance costs rise by 60%, while data breaches can result in staggering losses.

Enter AI and Generative AI. Institutions leveraging these technologies for security and compliance have cut breach costs by an average of US $ 2.22 million. By rapidly analyzing massive datasets, AI is transforming how firms manage compliance—making it faster, smarter, and more reliable.

This article explores how custom Retrieval-Augmented Generation (RAG) solutions are reshaping compliance and audit functions—helping financial institutions reduce risk, boost efficiency, and gain a strategic edge.

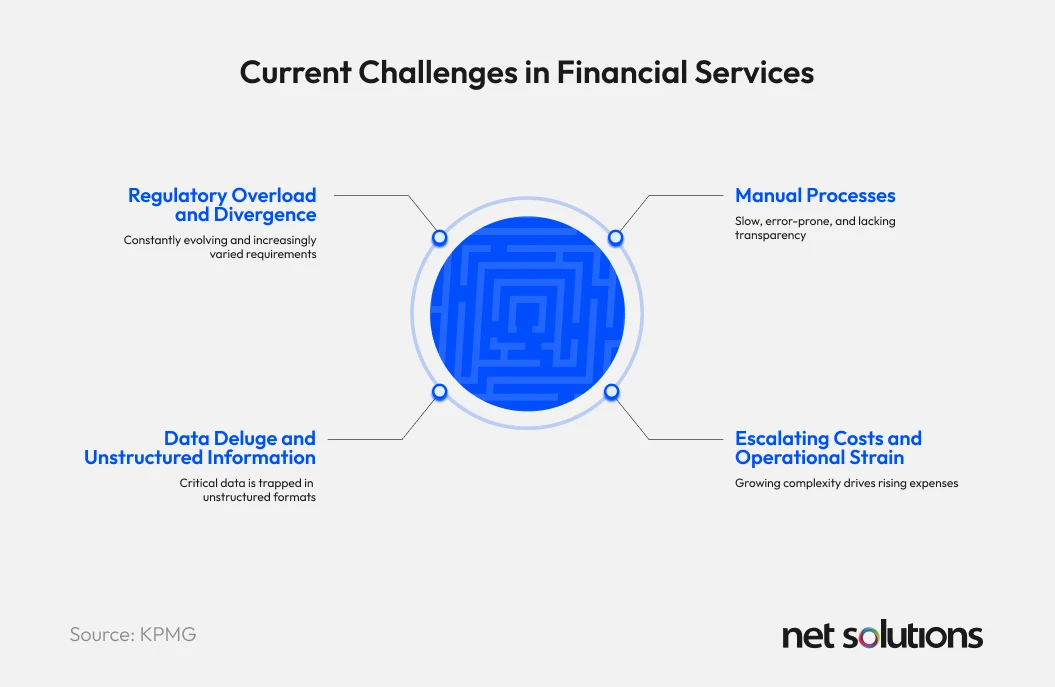

The Labyrinth of Compliance: Current Challenges in Financial Services

Financial institutions operate in a highly regulated environment where compliance has become increasingly complex. Rising regulatory demands, changing global standards, digital transformation, and stricter data privacy requirements have created significant challenges. Navigating these issues is no longer a straightforward process—each change introduces new risks, from financial penalties to reputational damage.

1. Regulatory Overload and Divergence

Financial institutions face a growing burden of ever-increasing regulations, making it hard to keep up. Professionals often cite “increased regulation” and a high “volume of compliance questions” as major hurdles. The regulatory landscape is constantly shifting, with new standards like the Economic Crime and Corporate Transparency Act 2024 (ECCTA), the EU Anti-Corruption Directive, the Corporate Sustainability Reporting Directive (CSRD), and the Digital Operational Resilience Act (DORA) emerging. Global standards such as GDPR have also significantly impacted data handling, setting a precedent for data privacy. Additionally, the evolving nature of illicit activities, particularly money laundering, presents an ongoing challenge for AML compliance.

A significant issue is the regulatory lag in digitalization. While the financial sector rapidly adopts digital transformation, especially with AI and machine learning, regulators struggle to keep pace. Despite this lag, more AI regulation is inevitable. This creates a “catch-22”: institutions must innovate digitally to compete, yet this immediately creates new, often undefined or rapidly evolving, regulatory complexities. Essentially, technological advancement continually demands new regulatory responses. The best approach isn’t to stop innovating, but to embed compliance from the start of digital transformation, requiring agile and adaptive compliance frameworks instead of reactive ones.

2. Data Deluge and Unstructured Information

Protecting sensitive financial data like bank statements, tax returns, and loan applications is crucial. But the massive volume of transactions overwhelms human teams trying to spot suspicious activity. Traditional systems struggle with unstructured data (voice, chat, emails, social media, images, video), which is increasingly vital for a complete risk picture and due diligence. Manual processes, like redacting sensitive info, simply can’t handle the vast document load.

This inability to process unstructured data creates a fundamental vulnerability in financial compliance. Much critical risk information is in these formats, which traditional systems can’t analyze. This “unstructured data black hole” leads to human error, missed risks, and higher costs. Effective solutions must convert this data into actionable intelligence to close information gaps and boost risk detection.

3. The Perils of Manual Processes

Manual financial processes are inherently slow, error-prone, and lack transparency. Common examples include:

- Spreadsheet-based transaction processing

- Email-reliant compliance reporting

- Manual data entry

These outdated methods create significant compliance and security risks. Human errors in monitoring and reporting increase AML violation likelihood. Manual record handling often results in incomplete customer data, leading to KYC issues and regulatory violations. Inaccurate financial reports, transaction discrepancies, and missing audit trails are further risks. Plus, manual systems often lack strong access controls, making them more vulnerable to unauthorized access and fraud.

AI-driven systems offer a compelling alternative to error-prone manual processing. For example, in marketing operations within financial institutions, AI-powered intelligence platforms can now automate campaign performance reviews, uncover behavioral patterns, and flag anomalies in real-time, all while significantly reducing human bias. These same principles can be applied across compliance functions to:

- Detect risks

- Eliminate redundant tasks

- Enhance audit readiness

AI reduces decision fatigue and error rates at scale. Manual audit tasks are prone to human errors in data and calculations, jeopardizing assessment integrity. Auditors also contend with cognitive biases (e.g., confirmation and anchoring bias) that can skew judgment. Relying on manual processes for high-volume, complex, and high-stakes tasks like compliance and auditing is unsustainable and risky. Human cognitive and capacity limits are not just inefficiencies; they’re fundamental vulnerabilities. Thus, automation isn’t just about cost-saving; it’s about mitigating human fallibility and capacity limits, thereby enhancing the financial system’s integrity and reliability.

4. Escalating Costs and Operational Strain

The sheer complexity and volume of regulations make financial compliance a significant and growing expense. Despite intense pressure from regulators to improve corporate compliance practices, simply adding more people to compliance teams is not a sustainable solution. For instance, Citigroup, despite having a team of approximately 30,000 risk and compliance employees, was fined $400 million, demonstrating that human scale alone is insufficient to contain costs or prevent penalties. While digital transformation is necessary, these initiatives also contribute to operational overheads as institutions must expand supporting business functions and technology capabilities to improve process effectiveness and drive compliance-led decision-making.

5. Audit Pitfalls in a Complex Landscape

Audits, while a cornerstone for providing assurance to shareholders, management, and stakeholders, sometimes fall short of their objectives, such as identifying fraud, ensuring accurate financial representations, or confirming compliance with regulations. Common pitfalls include management transparency and integrity risks, disorganized client systems, human error, and the increasing complexity of financial transactions and accounting standards. Rapid changes in accounting regulations pose significant challenges for both auditors and their clients, often leading to compliance issues if not correctly interpreted and applied. Integrating accounting practices with RAG enables finance teams to automate the interpretation of regulatory updates, reducing errors and ensuring timely adjustments to evolving standards.

Traditional auditing largely relies on sampling, which leaves inherent gaps in financial oversight and can miss discrepancies. This backward-looking approach often means that issues are uncovered months later, rather than in real-time, limiting the ability to prevent fraud or misstatements proactively. Modern accounting practices with RAG enable a shift from sampling to comprehensive, AI-driven analysis, thereby enhancing accuracy and audit effectiveness.

Traditional Approaches: Patching Leaks, Not Draining the Swamp

Limitations of Legacy Systems

Legacy data security processes are often manual, error-prone, and struggle with evolving compliance. Traditional rule-based systems are static; rules are predefined and only change with manual updates, making them rigid against new threats.

A major limitation, especially in Anti-Money Laundering (AML), is the high volume of false positives, which overwhelms compliance teams and reduces efficiency. Traditional background checks and compliance monitoring offer only static information, leaving organizations vulnerable to evolving risks like new legal issues or expired certifications. Similarly, traditional data warehouses provide static reports, limiting real-time decision-making.

While clear and auditable, rule-based systems, though a first line of defense, create a “false sense of security” due to their rigidity and high false-positive rates. They’re effective against known threats but easily bypassed by novel schemes, leading to a reactive compliance posture. Financial institutions relying solely on them are constantly playing catch-up, highlighting the need for a more adaptive, intelligence-driven approach that moves beyond static rules to dynamic risk assessment.

Inability to Adapt

Financial enterprises struggle to counter evolving money laundering tactics with traditional methods. Cybercriminals constantly exploit system vulnerabilities, demanding adaptable cybersecurity. Without continuous monitoring, new threats or changes in employee behavior (e.g., illegal activities, financial instability, expired licenses) go unnoticed, exposing institutions to risk. Static Large Language Models (LLMs), limited by their training data, can’t keep pace with dynamic data and evolving regulations.

This creates a “data staleness trap” in compliance:

- Organizations relying on traditional checks base trust on outdated information, missing emerging risks.

- Fine-tuned models can’t keep up with changing AI regulatory frameworks, policies, or customer data.

Traditional systems’ reliance on static or periodically updated data makes them ineffective in a rapidly changing landscape. Compliance is a continuous, dynamic process. Solutions unable to integrate and react to real-time information are inadequate, creating significant compliance gaps. This highlights the critical need for systems capable of continuous data ingestion and real-time leveraging of fresh information, moving from periodic snapshots to continuous monitoring.

The Need for a Paradigm Shift

Given the scale, complexity, and dynamic nature of modern financial regulation and the inherent limitations of traditional, manual, and static rule-based systems, incremental improvements are no longer sufficient. A fundamental paradigm shift, powered by Generative AI in finance, is essential for institutions seeking to move beyond static tools, ensuring continuous compliance, proactive risk management, and operational integrity.

RAG to the Rescue: A New Paradigm for Compliance Automation

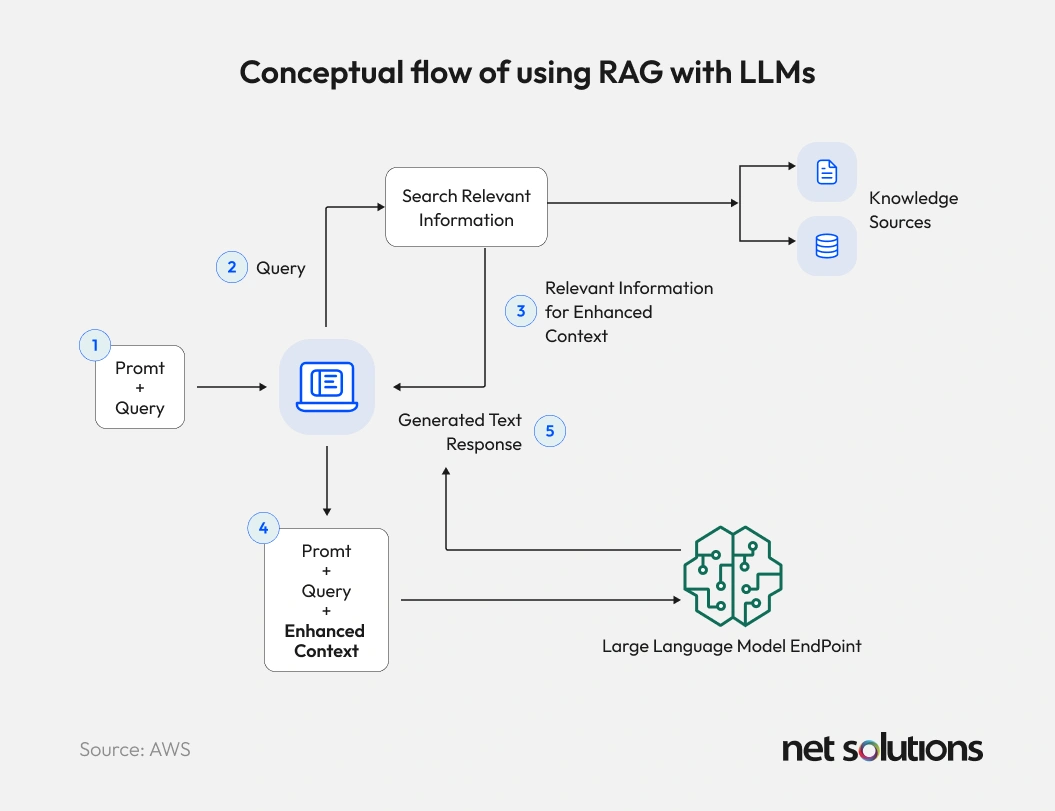

Understanding Retrieval-Augmented Generation (RAG)

Retrieval-Augmented Generation (RAG) is an advanced AI technique that significantly enhances Large Language Models (LLMs). Unlike traditional LLMs, RAG pulls relevant, real-time information from external knowledge bases (like internal documents or databases) before generating a response. The application of RAG in finance is particularly transformative, providing real-time insights from vast internal data, which static models and manual methods can’t match.

- Retrieval Component: A semantic search engine finds the most relevant information from a curated knowledge base based on a user’s query.

- Generation Component: This retrieved information (context) is combined with the query and sent to the LLM, which then generates a coherent, accurate, and verifiable response.

Effectively, RAG overcomes LLM limitations in finance by ensuring precise, explainable, and up-to-date answers, crucial for financial tasks.

Key Advantages of RAG for Financial Services

1. Factual Accuracy & Reduced Hallucinations

RAG significantly mitigates “gen AI hallucinations”—where LLMs generate inaccurate or fabricated information—by grounding their outputs in real, verifiable facts retrieved from authoritative sources. Studies have demonstrated a substantial reduction in hallucinations (e.g., a 35% reduction in question-answering tasks) when using RAG. This capability is critical for high-stakes domains like finance, where inaccuracies can lead to severe penalties and reputational damage.

RAG effectively addresses the “black box” criticism often leveled against traditional AI models, making AI more transparent, trustworthy, and reliable. This means RAG doesn’t just make AI smarter; it makes it accountable. This accountability, transparency, and verifiability are non-negotiable requirements for financial institutions, enabling them to adopt AI not just for efficiency but for maintaining regulatory compliance and public confidence. It fundamentally shifts AI from a potential liability to a verifiable and auditable asset.

2. Real-time, Up-to-date Information Access

Traditional LLMs are limited by their pre-trained data, which can quickly become outdated in dynamic environments. RAG overcomes this by providing access to fresh, real-time information from external knowledge bases, ensuring that decisions and responses are based on the latest regulations, market data, or internal policies. This real-time capability is crucial for dynamic industries like financial markets and regulatory compliance.

This paradigm shift isn’t exclusive to finance. In retail, for instance, brands are using real-time AI insights to personalize interactions and streamline operations—demonstrating how adaptable and scalable these solutions are across industries.

3. Contextual Relevance & Nuance

RAG excels at understanding the nuances of complex legal and financial documents, far better than basic keyword searches. By leveraging contextual information, RAG enables AI systems to generate responses that are precisely tailored to specific user needs and preferences, significantly improving the overall user experience.

4. Enhanced Auditability & Transparency

A key benefit of RAG implementations is their ability to offer transparent source attribution, citing references for all retrieved information. This is crucial for responsible AI practices and for meeting stringent regulatory requirements for accountability and traceability.

RAG creates immutable logs of retrieved data and generated responses, providing a verifiable trail for audits and regulatory reviews, a crucial advancement for accounting practices with RAG, where audit transparency and traceability are non-negotiable. This effectively “forces AI to ‘show its work'” by explicitly referencing the documents or databases used to generate responses, simplifying compliance reporting and building stakeholder trust.

5. Cost-Effectiveness & Scalability

RAG allows organizations to leverage their existing data and knowledge bases without the need for extensive and costly retraining of LLMs. This significantly reduces the costs associated with developing and maintaining AI systems. It translates to faster deployment and updates, as new information is simply added to the knowledge base rather than requiring a complete model overhaul.

6. Improved Data Security & Privacy

For enterprises handling sensitive financial information, RAG presents a more secure method by keeping proprietary and confidential data external to the LLM. This approach minimizes data exposure and allows for granular access controls, ensuring compliance with strict data privacy regulations. Unlike fine-tuning, where sensitive data is embedded directly into the model, RAG’s approach reduces the risk of data leaks and ensures compliance.

7. Agility and Adaptability

RAG is ideal for industries where the information landscape changes rapidly, such as financial markets or regulatory compliance. Its dynamic nature allows systems to evolve with the business without requiring substantial AI model updates or retraining. This adaptability is particularly valuable given the “data staleness trap” that traditional systems often face.

RAG offers distinct advantages over fine-tuning for LLMs, especially in finance:

- Data Freshness & Expertise: RAG directly integrates real-time enterprise data, ensuring high data freshness and incorporating domain expertise without modifying the core model.

- Efficiency: It requires medium setup effort, is flexible, and fast to update, unlike fine-tuning’s high effort, computational intensity, and time-consuming nature.

- Security & Privacy: RAG in finance provides higher security and privacy as data remains external and auditable, contrasting with fine-tuned models where embedded data needs careful compliance management.

A hybrid approach (RAG augmenting a fine-tuned LLM) combines deep domain expertise with real-time, verifiable data, offering specialized knowledge and current relevance—a powerful combination for financial services. Furthermore, RAG acts as a “force multiplier” for human expertise. By automating tasks like research, extraction, drafting, summarization, and review, RAG frees professionals to focus on strategic decision-making. This transforms financial professionals from data processors to strategic analysts, critical reviewers, and expert decision-makers, leading to:

- Higher job satisfaction

- Better utilization of skilled personnel

- More robust compliance and risk management outcomes

It fundamentally shifts the role from “doing the work” to “directing the work” with AI as an intelligent assistant.

Building Your RAG Solution on AWS: A Secure and Scalable Foundation

AWS’s Robust Infrastructure for Generative AI

Amazon Web Services (AWS) offers financial institutions the comprehensive services, advanced AI, robust infrastructure, and stringent security needed for scalable generative AI. Security and privacy are built into AWS from day one, protecting sensitive data when customizing foundation models. AWS provides tools and compliance advisors to help institutions manage and demonstrate their security posture to regulators, enhancing transparency.

Leveraging AWS for automation can significantly reduce compliance expenses, streamlining processes and optimizing resource allocation. AWS compliance advisors also help understand best practices for secure data storage, processing, and transmission, aligning with standards like PCI DSS, GDPR, HIPAA, SOX, and other financial regulations. This approach fosters innovation while safeguarding data and supporting compliance, enabling teams to push boundaries securely. For financial institutions, choosing AWS means leveraging a platform that inherently supports their complex regulatory obligations. This de-risks advanced AI adoption like RAG, as the infrastructure aligns with compliance, reducing internal burden and accelerating time-to-value. AWS is thus a “compliance-native cloud” for financial services.

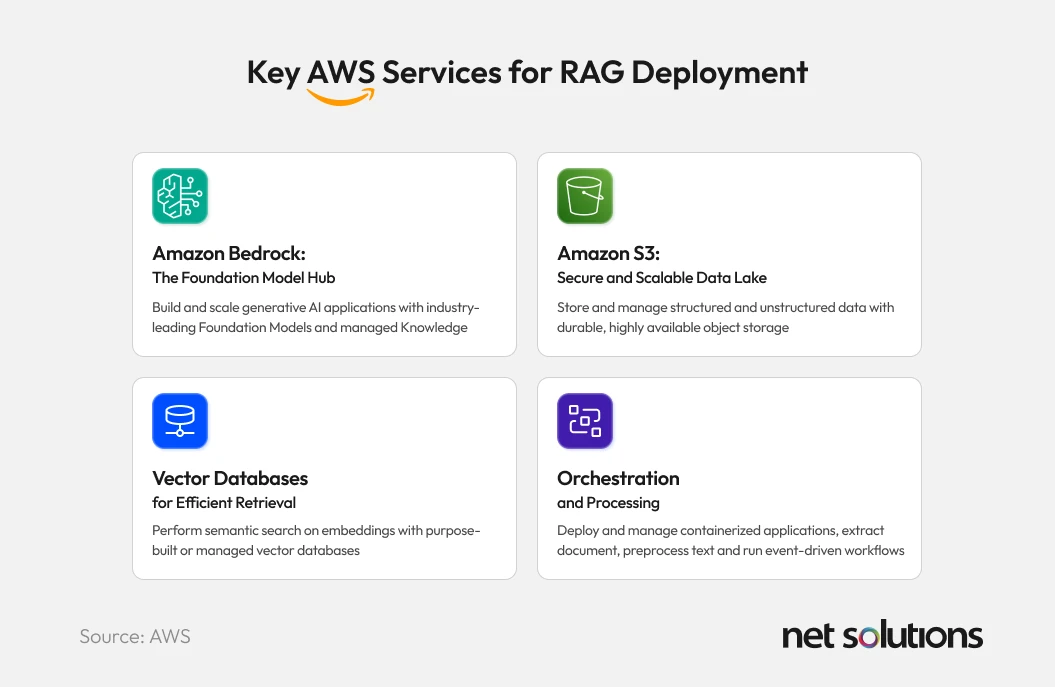

Key AWS Services for RAG Deployment

AWS offers a comprehensive suite of services that are instrumental in building and deploying enterprise-grade RAG solutions:

1. Amazon Bedrock: The Foundation Model Hub

Amazon Bedrock is highlighted as the easiest way to build and scale generative AI applications with Foundation Models (FMs). It provides access to a wide range of industry-leading FMs from Amazon (e.g., Nova), AI21 Labs, Anthropic (e.g., Claude 3.5 Sonnet), Cohere, Meta, Mistral AI, and Stability AI. Crucially, Bedrock offers managed Knowledge Bases for storing, retrieving, and structuring enterprise knowledge, seamlessly integrating with FMs to generate more informed and trustworthy responses. Bedrock now supports GraphRAG, an advanced feature that enhances traditional RAG by integrating graph-based retrieval to understand relationships between entities, facts, and concepts, leading to more contextually relevant and explainable responses. This advanced capability enables financial institutions to draw contextual connections between transactions, regulatory frameworks, and risk patterns in ways previously impossible using rule-based engines. GraphRAG not only boosts explainability but also strengthens the foundations of regulatory reporting.

For a broader view of how industries are leveraging Bedrock’s capabilities to deploy production-grade generative AI solutions, you can check out our blog on AWS Bedrock Use Cases. You’ll discover real-world applications that underscore Bedrock’s scalability, compliance-readiness, and performance in high-stakes environments, such as finance.

2. Amazon S3: Secure and Scalable Data Lake

Amazon Simple Storage Service (S3) is the primary service for storing knowledge base documents for RAG solutions. It provides secure, scalable, and durable object storage, which is fundamental for managing the vast amounts of structured and unstructured data required for RAG systems.

3. Vector Databases for Efficient Retrieval

For efficient semantic search, AWS offers options like Amazon OpenSearch Service. For specific data residency requirements, local vector databases (e.g., ChromaDB or Faiss on Amazon EC2, or Amazon Relational Database Service (RDS) for PostgreSQL with the pgvector extension) can be deployed on AWS Outposts. Amazon Neptune Analytics is also available for GraphRAG, allowing for complex queries that combine semantic search with precise filtering on structured fields like company names, filing dates, or specific financial metrics.

4. Orchestration and Processing

AWS services like Amazon Elastic Kubernetes Service (EKS) provide a scalable, secure, and cost-efficient environment for deploying containerized RAG applications, automating the provisioning and lifecycle management of nodes. Amazon Textract can be utilized for document text extraction, and Amazon Comprehend for advanced text preprocessing. AWS Lambda functions and Step Functions can orchestrate the RAG ingestion pipeline, handling data processing, embedding generation, and indexing. Amazon SageMaker can be used for creating vector embeddings.

Managed services for RAG (e.g., Bedrock Knowledge Bases, EKS, OpenSearch Service, S3) significantly ease adoption for financial institutions. They can leverage pre-configured, scalable components instead of building infrastructure, accelerating time-to-market for compliance solutions. This “managed service advantage” lets institutions focus expertise on customization and strategy, not heavy lifting.

Furthermore, AWS tackles data sovereignty challenges for global financial institutions. AWS Outposts and Local Zones enable processing sensitive data at the edge, keeping it within geographical boundaries. For instance, documents on an Outpost rack remain local, never transferring to an AWS Region. This “data sovereignty solution” allows RAG deployment with local, sensitive data, benefiting from cloud-scale AI while ensuring compliance with strict data protection regulations. This is a key differentiator for highly regulated global enterprises.

Enabling Enterprise-Grade RAG

AWS provides a scalable, secure, and cost-efficient environment for building RAG applications, enabling efficient deployment and monitoring of AI-driven workloads. Optimized implementations can achieve sub-2-second response times for most queries and handle over 50 simultaneous requests.

AWS offers robust security controls for data protection, access control, network security, logging, and monitoring throughout the RAG ingestion workflow. Data is encrypted in transit using TLS, and customer data is not persistently stored in Amazon Bedrock service accounts.

AWS supports IAM-based access control, secrets management best practices, and cost monitoring. Moreover, AWS encourages continuous evaluation of RAG systems to maintain accuracy and reliability, using frameworks like RAGAS for automated metrics, a critical benefit when deploying accounting practices with RAG in highly regulated environments.

This allows for ongoing optimization of retrieval and generation components, ensuring the RAG solution remains effective and compliant.

Embracing the Future of Financial Compliance

By automating burdensome tasks, ensuring unparalleled accuracy, and delivering real-time, auditable insights, RAG fundamentally transforms financial operations. This empowers professionals to dominate strategic decision-making and high-value initiatives. Leveraging RAG on AWS isn’t just about avoiding penalties; it’s about forging an ironclad reputation for integrity and operational excellence, reallocating resources from constant crisis management to groundbreaking innovation.

Compliance evolves from a mere cost center into a formidable strategic differentiator, securing a resilient and dominant future for financial services. The financial services sector confronts a critical juncture. Obsolete compliance and audit methodologies are inadequate to manage the incessant proliferation of regulations and the deluge of data. A reactive and expensive compliance posture is demonstrably untenable.

Tailored RAG solutions, underpinned by the uncompromised security and robust infrastructure of AWS, represent not merely a choice but the essential trajectory, enabling institutions to embrace a proactive, intelligent, and efficient future. To implement such intelligent and adaptive systems at scale, financial institutions are increasingly turning to expert-led Generative AI Services that combine technical precision with deep regulatory understanding.