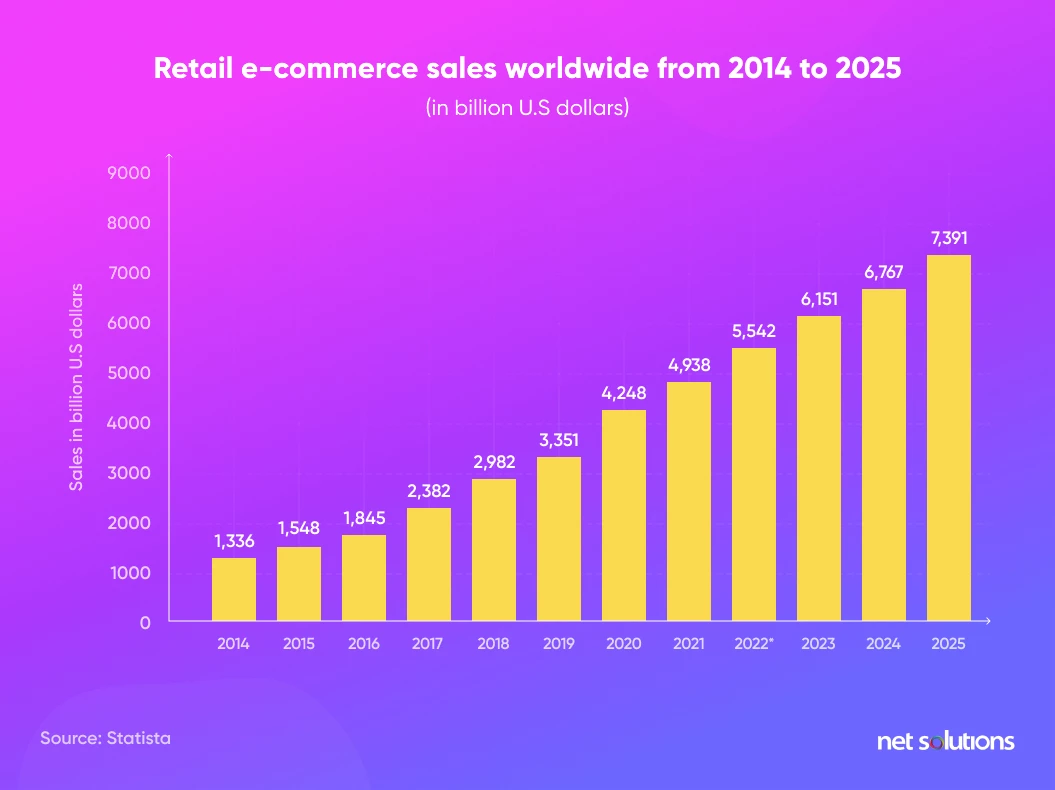

The evolution of the digital commerce industry is powered by its innovative integration of advanced solutions, adaptive technology at its best, and extensive customization. The eCommerce industry is expected to grow further in exponential ways. Look at what the data says:

This establishes enormous responsibility on the eCommerce shop owners and businesses to match their pace with this ever-changing industry. There are so many challenges for eCommerce businesses; smart decisions need to be made, and every wrong decision can be catastrophic. A payment gateway refers to software that securely interfaces between an eCommerce website and a customer’s preferred mode of payment, which can be their bank account, credit card, debit card, gift card, or any online wallet.

Gartner puts it across as,

Payment gateways initiate payments at the request of merchants and return the responses to those merchants. They offer preexisting connections and certified integrations with key payment acquirers and processors, and many have integrations with other providers in the greater digital commerce ecosystem. All digital commerce payment vendors offer a software-as-a-service (SaaS) payment gateway at a minimum. Many are full-stack providers that include processing and acquiring capabilities, alternative payment methods, fraud detection, payment data tokenization, and other related or ancillary services.

Some of the best payment gateways for 2024 are Authorize.Net, Stax, Stripe, Helcim, Square, Payment Depot, Braintree, PayU, Amazon Payments, PayPal, and Skrill. With the help of an online payment gateway provider, it becomes easy to accept and process several tynic paypes of electroments.

Instead of setting up and running all the software, hardware, connections, and security, online payment gateway services offer a complete all-in-one solution. For many small businesses, the ease of a payment gateway is an excellent way to run custom eCommerce Solutions.

Selecting and integrating the right payment gateway provider isn’t challenging or cost-restrictive if retailers understand the business needs. Doing it right can immediately and positively impact their brand’s customer experience and profitability.

Here are some of the questions retailers should ask themselves before choosing a payment gateway provider:

- What will be the service cost?

- What features do they provide, for example, fraud security and virtual terminals?

- Is it compulsory to have a merchant account for the chosen gateway?

- Does the payment gateway support the online store’s country?

To better understand the importance of these questions, let’s get into further details about how payment gateways work.

We respect your privacy. Your information is safe.

What is an eCommerce Payment Gateway?

A payment gateway is a software application that enables the secure transfer of card/bank information from a website to the payment network for eCommerce payment processing. Then it returns transaction details and responses from the payment network to the website. Although online transactions appear quick and straightforward, several processes work together at the backend to move funds seamlessly and securely from buyer to seller.

As per Statista,

- Total transaction value in the Digital Payments segment is projected to reach US$8.49tn in 2022.

- Total transaction value is expected to show an annual growth rate (CAGR 2022-2027) of 12.31% resulting in a projected absolute amount of US$15.17tn by 2027.

- The market’s largest segment is Digital Commerce, with a projected total transaction value of US$5.49tn in 2022.

How does an eCommerce Payment Gateway Work?

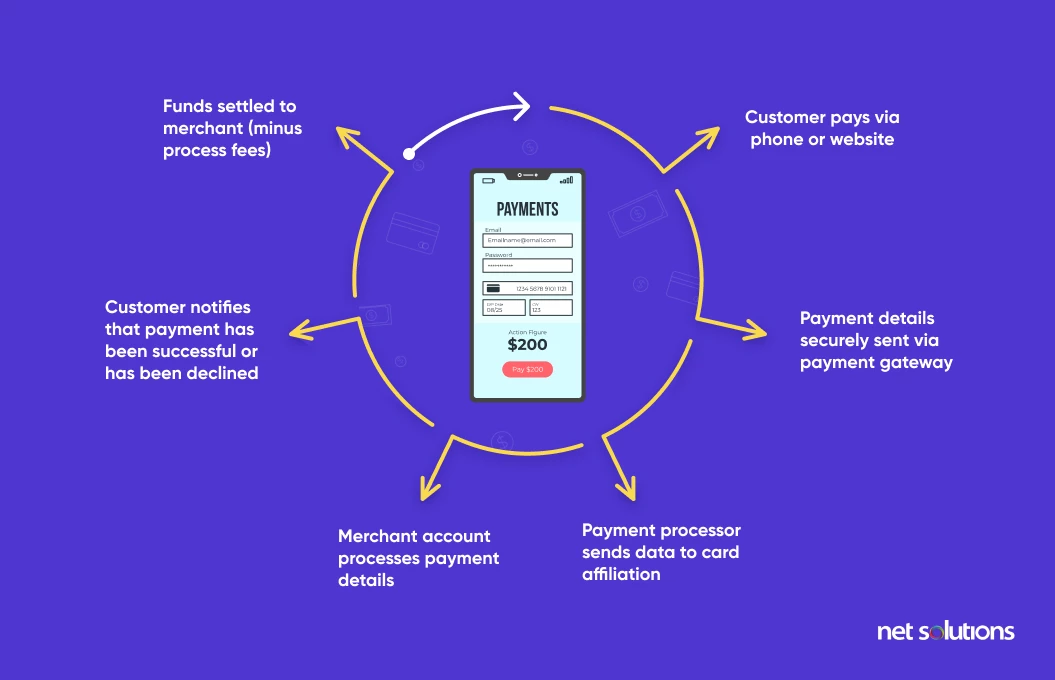

The motto behind payment gateways is to make payment processing effective, secure, and hassle-free. Instead of transmitting payments, the payment gateway approves the funds transferred to the seller and does so safely and securely for the buyer.

Payment gateways even observe PCI compliance standards to prevent fraud, introducing various security techniques as expected. Below are the steps showing how the payment gateway for eCommerce works:

-

- Step 1: The process starts when customers place an order on an eCommerce website and fill in their credit card essentials.

- Step 2: The web browser encodes the data sent between it and the merchants’ web server.

- Step 3: Next, the gateway sends the transaction data to the payment processor used by the merchant acquiring bank.

- Step 4: The payment processor sends the transaction data to a card affiliation.

- Step 5: The credit card’s issuing bank sees the approval request and “approves” or “denies.”

- Step 6: The processor then forwards an approval related to the merchant and customer to the gateway.

- Step 7: Once the gateway acquires this reaction, it transmits it to the site/interface to process the payment.

- Step 8: ‘Clearing Transactions’ is activated once the merchant has completed the transaction.

- Step 9: The issuing bank changes the “auth-hold” to a debit, permitting a “settlement” with the vendors’ securing bank.

12 Important Factors to Consider when Choosing a Payment Gateway Provider

Before making any decision to choose an eCommerce payment gateway provider, depending upon the business and functional requirements for the eCommerce business, given below are the factors which should be considered:

1. Choose an Appropriate Payment Flow

As the business grows, the eCommerce payment gateway should be able to scale along effortlessly. Retailers must select the most appropriate payment flow for their business to add a payment gateway to a website.

- A site with an integrated payment form is used to send information to a secure payment gateway: With this option, payment details are transmitted through a particular form. The form contains all the required information and passes it to the gateway provider through API calls. This may require additional programming and, therefore, boosts the overall cost of the payment gateway integration process.

- iFrame or redirect for payments: Either customers are redirected to a secure, hosted payment page, or they are required to enter their information in an embedded iFrame on the website. Developers can leverage this option as it takes less time to integrate.

- Having an Escrow system: This payment gateway option suits certain businesses. A secure escrow system built within the eCommerce platform can withhold funds before the admin grants the proper authority. If the platform works as an intermediary in trading operations or serves as an online marketplace, the traded funds of the two parties will be stored safely and arbitraged while the deal is in process.

2. Choose the Correct Product

A payment gateway provider is required on every website when selling products and services online. It allows customers to buy a product or service, while business owners receive these payments hassle-free. To choose the right product, retailers should consider how adaptable their payment solution is while keeping its security in mind.

It’s also essential to figure out how to add a payment gateway to the website – this doesn’t mean retailers have to do it themselves; they should hire an expert to take care of this. Select the best online payment method for the business and the customers.

3. Make Customers Feel Safe and Secure

Big companies have taken the online shopping experience above and beyond – raising customer expectations from all eCommerce websites. Even if websites run small businesses, customers expect high-quality websites that run on the most secure payment options. If they’re selling online, they are directly or indirectly competing with the likes of Amazon, Walmart, etc.

For instance, some payment gateways allow website owners to customize the whole payment experience to reflect their brand’s typeface, logo, and color palette. Some customers don’t realize they might temporarily be redirected to a third-party website to process their transactions safely.

Make sure the payment gateway provider is certified for following information security standards like PCI-DSS. PCI Standard is mandated by the card brands but administered by the Payment Card Industry Security Standards Council.

4. Consider Fees and Service Agreement Requirements

Pricing for payment gateways is commonly based on the type of transactions a business conducts (online or in-person) and even business sales, revenue consistency, transaction frequency, and the markets served.

It is sensible to compare how the e-commerce business model accommodates and coincides with the payment provider or a gateway’s fee structure. A few services may require setup fees and contracts, or they may charge transaction fees if a particular order and transaction volume aren’t met.

5. Transactional Efficacy

According to a survey, more than 25 percent of customers will abandon a purchase if compelled to register for an account to complete it. If the checkout procedure uses a third-party shopping cart with an enrollment procedure built into the cart, ensure that retailers can make it an optional factor that allows for a “guest” checkout.

Likewise, the payment gateway should enable retailers to remove unwanted form fields for a more straightforward checkout process. Big eCommerce businesses expect online retailers to boost conversions by up to 50% by eliminating redundancies, such as wanting the customer to enter billing and shipping information, even if the postal addresses are the same.

6. Make Checkout Easy on All Devices

Studies reflect that 79% of smartphone users have purchased online using their mobile devices in the last 6 months, 62.24% of people own a mobile phone in 2021, and these figures are increasing steadily. As website owners evaluate their payment gateway options, they need to provide an adaptable checkout experience optimized for different mobile devices and network types.

7. Multifaceted Functionalities

Online payment gateway service providers offer several features depending on their business needs. For example, suppose retailers provide their products and services worldwide. In that case, the payment gateway should provide a global solution and accept several credit cards, debit cards, and currencies in different countries.

Payment gateways also impact the website’s efficiency. Be sure to find out if the chosen payment gateway supports electronic invoicing, all payment types, text/email reminders for customers, smart chargeback management, etc.

8. Easy Integration Process

Online payment gateway integration isn’t a DIY process. Most payment gateways provide detailed instructions on integrating into popular eCommerce platforms like WooCommerce, Shopify and Magento, etc. The ideal solution is to select a payment gateway system that doesn’t botch up the website’s UX with a slow payment process. Select a payment gateway that makes it easy and beneficial for the customers to make payments on the website, where they can select a payment method of their choice.

9. Merchant Account

It is crucial to have a merchant account to receive funds through an online payment gateway.

What is a merchant account? It’s used when customers make an online payment through a payment gateway; the money is temporarily transferred to a separate retailer account. This is different from the existing bank account. The cash stored in a merchant account has to wait until it gets approved by the customer’s processing bank. After approval, the money is transferred to the bank account.

Even though it seems an extra task, merchant accounts provide an extra layer of security and funds management for sellers and buyers. Alternatively, some payment gateways do not require a merchant account and transfer money directly to the seller’s account. In such cases, payment gateways can charge a higher processing fee.

10. Recurring Billing

Recurring billing allows retailers to set up an automatic billing cycle for their customers, making it an absolute necessity for companies with monthly payment plans. Subscription-based services like Netflix run on a recurring payment model. Moreover, non-profits have found utility in recurring billing, as this functionality enables organizations to collect funds from regular contributors effortlessly.

11. Mobile Payments

Mobile payments will replace credit card buying in the coming years, even in point-of-sale environments. With the help of mobile payments, payment gateway providers enable buyers to transfer money using their mobile phones, either with top branded apps or with a mobile-optimized site.

Mobile payments are powered by payment gateways but are optimized for mobile devices like phones and tablets. The rise of digital mobile wallets like Apple Pay, Google Pay, Samsung Pay, etc., has changed how customers pay through mobile, and payment gateways are adding support for all major digital wallets.

12. 24×7 Customer Support

Several payment gateway services limit their support to tickets or emails. In this situation, users must follow manual instructions to fix a problem. If the website owners feel more comfortable talking to a person instead of sending emails, check whether the provider offers live technical support, at least within standard working hours, so that they can quickly resolve any technical problems.

Best Payment Gateway for Small Businesses and Startups

Small businesses or startups that rely on CMS like WordPress/Shopify and don’t want to invest in larger e-payment gateways – can choose simpler, more CMS-integrated payment solutions for their business.

1. WooCommerce Payments

WooCommerce is a plugin that turns WordPress into an eCommerce platform. With $0 billed annually and no monthly fees, WooCommerce Payments is a convenient way to manage transactions. Due to the CMS-wide integration with WordPress, retailers can use all the features, which were previously available on third-party websites, straight from the WordPress dashboard.

2. Shopify Payments

Shopify is perhaps the most widely used eCommerce platform in the world right now, so it makes sense for Shopify to provide its payment gateway for its customers.

Along with all the primary payment gateway mobile app features, Shopify Payments supports stores in most countries that run Shopify. Like WooCommerce integrates with WordPress, Shopify Payments is a native feature that can be accessed straight from the Shopify dashboard. However, Shopify Payments doesn’t provide free service and comes with a starting plan of $29/month.

Other Things to keep in mind while choosing a payment gateway

Questions that cross almost everybody’s mind: What is the cheapest payment gateway? Are there any hidden costs? How long does it take to process the money? How much will Chargebacks cost?

Dig a little deeper to find the answers and ask vendors about:

- Rates for rewards, business, and international cards: These rates are not the same as standard transaction fees. Find out if they’re higher than your budget allows.

- Minimum limit and annual fees: A minimum limit means the eCommerce website has to make a sale of that set minimum amount. Otherwise, websites can be charged extra. Some payment gateway providers also charge annually instead of charging on minimums.

- Chargebacks: Chargebacks are transactions with the dispute. Customers can raise a dispute and have their money returned to them. A merchant receives this request and reverses the transaction.

- PCI compliance: PCI compliance is an information security standard for secure card payments. All businesses may be unable to undertake this compliance due to high costs; in that case, retailers can use a payment gateway vendor that offers affordable rates. Retailers should ask the payment gateway provider about PCI compliance before finalizing anything.

Some of the top Payment Gateways for Your eCommerce Business

While choosing the payment gateways, ensure it meets all the business requirements and depends on experts’ suggestions based on reviews or feedback. Here are some of the top payment gateways that we recommend that suit the ideal business needs:

1. Authorize.Net

Established in 1996, it is considered one of the popular payment gateway providers for the eCommerce business. About 400,000 merchants use the Authorize.Net payment gateway through credit cards and electronic checks.

Merchants deal with their accounts via Authorize Net’s Merchant Interface. They can set up several user accounts to control access. With an extra feature, Authorize.net is an easy win. Experts even consider it a good match for Magento stores and eCommerce.

Authorize.Net Processing Fees: 2.9% on transactions with an additional $0.30 per transaction for their “all-in-one” payment provider option.

Pros of Authorize.Net Payment Gateway:

- A wide range of currencies supported

- Robust security and anti-fraud features

- No long-term contracts

Cons of Authorize.Net Payment Gateway:

- High flat-rate pricing for an optional merchant account

- The all-in-one option may confuse customers

2. Stripe

Set up in 2010, Stripe is one of the top payment gateway providers that provide payment processing solutions to merchants. Their comprehensive developing tools set them apart from other payment processing suppliers. Stripe has an essential commitment to eCommerce as a capable and adaptable API, enabling website owners to customize the platform as per their necessities.

It counts several incorporated applications: this means that they are not required to be an expert in coding: they can begin using it instantly. This online payment takes 7 days to process the payment and has no hidden expenses.

Stripe Processing Fees: 2.9% + $0.30 per domestic transaction

Top Brands Using Stripe Payment Gateway: Slack, Shopify, GitHub, and Spotify

Pros of Stripe Payment Gateway:

- Accessible documentation resources make customization onto the site simple and easy

- Ideal for international merchants

- Excellent website & advertising

Cons of Stripe Payment Gateway:

- Not suitable for high-risk industries

- Account stability issues

3. Braintree

Established in the year 2012, Braintree presently tops our mobile payment gateway platform suggestions. Financed by venture capitalists and enthusiastic investors, Braintree is different in its programming, and the code can be explicitly set into a merchant’s online site.

As a PayPal service, it offers a secure checkout experience to customers, thus encouraging them to return to the website. It is an ideal payment gateway for eCommerce businesses looking to process payments proficiently and enhance their order management.

Braintree Processing Fees: Standard 2.9% + $0.30 fee for every transaction processed through it.

Top Brands Using Braintree Payment Gateway: Uber, Dropbox, GitHub, and Yelp

Pros of Braintree Payment Gateway:

- Predictable flat-rate pricing

- Availability of extensive integrations

- Multi-currency options

Cons of Braintree Payment Gateway:

- Businesses without developer resources can’t use Braintree’s API

- No integrated online and offline solution

- Long setup times for account

4. PayU

PayU, a product of an Indian payment-processing corporation, is one of the easiest eCommerce payment solutions designed to fill in the gaps left by complex service providers. PayU is favored because of its best conversion rates and acceptance over several other payment methods. The PayuBiz APIs and SDKs help connect this platform to any website, application, or associated third-party system.

PayU allows payment with just a single tap. It made a significant technological breakthrough by allowing second-time/repeat customers to skip keying in their CVV repeatedly. The platform even provides reading and submitting OTP on behalf of the customers and conforms to the highest PCI and DSS standards to ensure payment information.

PayU Processing Fees: 2.9% with an additional $0.30 per transaction

Top Brands Using PayU Payment Gateway: Netflix, Airbnb, and Bookmyshow

Pros of PayU Payment Gateway:

- Tokenization allows retailers to store their customer’s credit card data safely

- Go live within minutes and start accepting payments in less than 5 minutes

Cons of PayU Payment Gateway:

- High frequency of crashes and lags

- Frequent changes in the business model

5. Amazon Payments

Amazon Payments is an eCommerce payment gateway that provides customers with a secure and simplified payment service for customers. The service is available to merchants and customers to facilitate their online buying. It completely works on the data already inserted by the customer in their Amazon account to complete check-ins and checkouts.

With the help of a single login, the customer is instantly recognized and allowed to complete the transaction through either the web or mobile. Amazon payments can be made in several languages, supporting all leading currencies to reach international audiences.

Amazon Payments Processing Fees: 2.9% on domestic transactions with an additional $0.30 per transaction. International fees escalate to 3.9%.

Top Brands Using PayU Amazon Payments: Lootcrate, Rothys, and MVMT Watches

Pros of Amazon Payments Gateway:

- Amazon offers no additional charges for its A-to-Z Guarantee, which makes the transaction 100% secure.

- Easy to customize Amazon Payments into the existing look and feel of the site.

Cons of Amazon Payments Gateway:

- Expensive for high-volume merchants

- Not recommended for businesses looking for one processor to handle both in-person and online transactions

6. PayPal

Founded in 1999, both MasterCard and credit card payments can acknowledge, and it is free for buyers, while merchants need to pay transaction fees while using PayPal for Visa payments. This eCommerce payment gateway provider does not require setup expenses, gateway fees, or monthly charges.

Recently, PayPal completed the acquisition of Honey Science Corp. (a digital shopping and rewards platform) for about $4 billion in cash.

The advantage is that merchants do not have to pay once the sale is made. While using PayPal Standard, customers may leave the site to check out and sign in to their PayPal account, or they can pay via credit card or Visa without signing up. PayPal Pro enables merchants to modify their entire checkout process, so consumers do not have to leave the site. It also accepts credit cards via fax, mail, or phone.

PayPal Processing Fees: 2.9% per transaction, with no monthly fees

Top Brands Using PayPal Payment Gateway: Adidas, Disney, ASOS, and Etsy

Pros of PayPal Payment Gateway:

- Ideal for low-volume merchants

- Predictable flat-rate pricing

- All-in-one payments system

Cons of PayPal Payment Gateway:

- Not suitable for high-risk industries

- Inconsistent customer support

Here’s How We Launched a Unique Fashion Brand Using Magento eCommerce

Olah Inc. approached Net Solutions for the development of an e-store named The Style Library LLC. Designed to serve an exclusive class of customers. The primary requirements of the client were:

- Exclusivity on the site (to ensure that they work with and maintain top-notch clientele.)

- Maintaining the store’s inventory and sending regular reminders to customers with items on loan.

- Integrating easy payment options to make the experience pleasant and seamless for customers

Skrill

Skrill is a UK-based eCommerce payment gateway designed for both businesses and consumers. With the help of Skrill, retailers can make international transactions and pay for products and services wherever they are with the help of a dedicated mobile app. Active users can submit a request for a prepaid Mastercard and use it to pull back assets/buy products wherever they might be.

Skrill is simple to connect to any bank account globally and takes good care of the security of the payment data. There are no charges for creating an account on Skrill, but there is a fixed percentage of charges on what they send or receive.

Skrill Processing Fees: 1.9% transaction fee

Pros of Skrill Payment Gateway:

- Supports in-app payments

- Integrates with third-party shopping carts

- Hosted payment page

Cons of Skrill Payment Gateway:

- Expensive fees (Convenience comes at a price, with lots of fees, including a currency conversion fee of 3.99%)

- Account stability issues

2CheckOut

If you are looking for instant payments, there is nothing better than 2CheckOut. It is a fully-featured payment processing solution that appears on all similar top lists and classifications. This prominent US-based leading payment gateway provider enables the business to be a global moneymaker with 15 different languages and 87 currencies.

It supports different languages with different currencies with a sandbox feature that connects retailers to the marketplaces. Keeping the business in mind, it customizes every detail of the checkout, delivering a personalized user experience to its customers.

2CheckOut Processing Fees: 2.9% + $0.30 per domestic transaction

Top Brands Using 2CheckOut Payment Gateway: Bitdefender, Advisera, and myFICO

Pros of 2CheckOut Payment Gateway:

- Accessible documentation resources make customization onto the site simple and easy

- Ideal for international merchants

- Excellent website & advertising

Cons of 2CheckOut Payment Gateway:

- Not suitable for card-present merchants

- Not good for high-risk merchants

Orangepay

Orange Pay is one of the top payment gateway providers. It is known for assisting complex tasks, as it can offer comfort and reduce risks by guaranteeing consistency with laws while protecting fake transactions. Orangepay minimizes the risk of rebelliousness for different approaches. Likewise, SSL encryption and 3D security secure private information.

This payment gateway provider offers great comfort to users by supporting a vast selection of popular payment channels, including VISA or MasterCard, Bitcoin, Qiwi, PayPal, Krill, etc. In 2018, it received the ‘Great User Experience’ award by FinancesOnline. Payment options are adaptable to suit different industry standards, thus making it a perfect choice for handling FOREX market companies, freelancers, and so on.

Pros of Stripe Payment Gateway:

- Anti-DDoS

- Chargeback Control

- Remote Account Opening

Cons of Stripe Payment Gateway:

- Not suitable for high-risk industries

- Inconsistent customer support

BlueSnap

A dedicated payment processor for merchants and retailers, BlueSnap helps to enhance the eCommerce business by supporting payment types with different languages and currencies. One can integrate it with all top marketplaces and shopping cart platforms with direct payments. One can even use it to create exclusive desktop and mobile applications for SaaS (Software as a Service), gaming, invoicing, etc.

It is even notable for its Subscription Billing Engine, and clients can pay without the inconvenience of entering MasterCard or credit/debit card data.

BlueSnap Processing Fees: 3.9% + $0.30 per domestic transaction

Top Brands Using BlueSnap Payment Gateway: Vodafone, Semrush, Cakemail, and Autodesk

Pros of BlueSnap Payment Gateway:

- Month-to-month contracts with no early termination fee

- Fully-featured payment gateway

Cons of BlueSnap Payment Gateway:

- Flat-rate pricing is expensive for medium or larger-sized businesses

- $75 per month account maintenance fee for merchants processing less than $2,500

Before choosing and implementing the right payment gateway provider, you must consider the above-discussed factors. Another good case practice is to hire an expert and let them deal with all the technical aspects of integrating a payment gateway. If businesses want more clarity on how payment gateways work for small and large eCommerce businesses, feel free to contact us.

Frequently Asked Questions

1. Can we have multiple payment gateways on one website?

Although a slightly more expensive option with greater processes & analytics involved, it is possible to have multiple gateways. This enhances customer satisfaction and increases sales.

2. Are payment gateways and processors the same?

No, while payment gateways refer to the software applications enabling a secure transfer of information of the payment mode to the payment network, the payment processor is a financial institution. It executes transactions to obtain customers’ funds, transferring them from the customer bank to the merchant bank.

3. How can you secure online payments through payment gateways?

Online payment methods are secured by taking measures like PCI-DSS compliance, Tokenization, Secure Socket Layer (SSL) certification, adherence to the Secure Electronic Transaction (SET) & 3d Secure 2.0 protocols, and protecting sensitive data with data encryption. Strong Customer Authentication (SCA) also helps to reduce fraud.

4. Does it take very long to establish and set up payment gateways?

Setting up payment gateways is not a cumbersome process on its own. It can take a maximum of 3-5 working days. However, the finalization would depend on the process of bank application and the kind of customization you want for your payment model.