What makes some apps “stick” while others fade away into obscurity? A great way to answer that question is to start by looking at the best mobile apps list on the market.

That’s why we’ve decided to catalog the top apps in 2024, highlighting a few of the features that make them stand out. This list will inspire you if you’re an entrepreneur with an app idea or a business leader looking to up your mobile game. It will also give you a sense of what works for some of the world’s top tech companies, so you can emulate their success.

The Most Important Lesson? Solve a Problem

Whether you’re an entrepreneur with a new idea or a marketing leader trying to find better ways to serve your customers, all the best app ideas that follow have one thing in common. They use mobile technology to solve a problem. If you can solve a significant problem for a solid segment of the market, you’re in business.

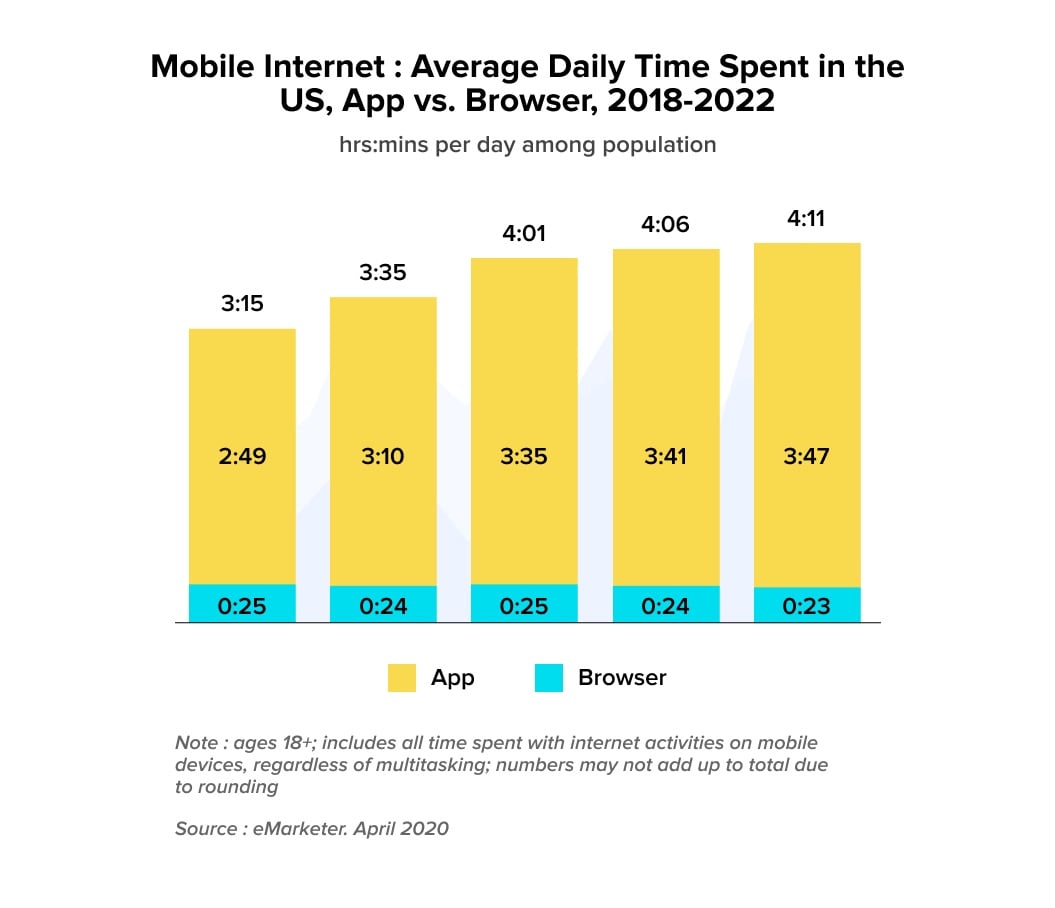

With an ever-growing market, advances in technology, and evolving consumer demand, mobile applications help businesses stay relevant and competitive. The online magazine eMarketer found that the average US adult increased their time spent on mobile devices by 31 minutes in 2022, with 88% of their total mobile internet time spent inside apps.

In other words, the demand for mobile technology is strong and growing. The world loves apps and they’re willing to use them, but there’s a reason why most apps fail. If you want to ensure strong mobile engagement, you need to develop an app that solves a problem and delivers a user experience.

The following 10 top smartphone apps do just that.

We respect your privacy. Your information is safe.

What are the Most Popular Apps in 2024

To help you develop a mobile app that stands out from the competition, take a look at the top 10 trending apps of 2024 and see what they’re doing right.

Uber

Uber is the world’s leading on-demand ride-sharing service, connecting 103 million riders to drivers in over 70 different countries across the globe.

Uber has plenty of competitors today, but they continue to dominate the U.S. Market, with 71% of that market share in the mobile app development market. They also have a powerful presence in most countries across the globe (their exit from Russia and China not with standing).

What made Uber so successful? Obviously, being first-to-market was a great advantage, but the app itself offers a superior user experience as well—something anyone can attest to when they’ve tried using local competitors in various parts of the world.

A few things the Uber app does right:

- Excellent GPS integration with Google Maps, allowing users to drop pins in precise locations and giving them the option to make their location known to the driver.

- Seamless payment processing, with the option to pay in cash in parts of the world where credit cards are less widespread.

- Price calculation so riders know what they’re paying upfront. We’re all used to this by now, but this was an innovative feature when it launched.

Price: Paid as per ride.

One of the world’s largest social media platforms, with 1.4 billion monthly users, Instagram offers an easy way to connect through images and videos. Launched in 2010 and purchased by Facebook in 2012, Instagram is extremely popular among Millennials and Gen-Zers, making it a powerful channel for advertisers trying to reach those segments.

A few things the Instagram app does right:

- The “stories” feature first appeared on Instagram before it spread to Facebook, making it easy to capture videos and photos that would automatically disappear within 24-hours.

- In-app video and photo editing for on-the-spot uploads.

- In-app shopping, allowing users to connect with brands they love and browse new products for sale.

Pricing: Free.

TikTok

TikTok is a popular app, built by the Beijing-based firm ByteDance, for creating and sharing short videos. Among the most popular genres on the platform are lip-syncing and dancing, but many use it for highly-creative short films. Once the favorite among the under-18 crowd, TikTok has gone mainstream.

A few things the TikTok app does right:

- A highly-effective algorithm figures out what users want to see, and it keeps them coming back. Sure, every social media site does this, but TikTok is “sticky” beyond belief—with the average user spending 52 minutes per day on the app, and with 90% of their monthly users accessing it daily.

- Automatic filters that make everyone look a bit better on camera. Maybe this is not the best for teaching self-acceptance and body-positivity, but it sure does drive engagement.

- Duets feature, allowing users to collaborate on different devices to create group videos. Since lip-syncing is all the rage on TikTok, this comes in handy with videos like this one, where users add on to existing viral videos.

Price: Free.

Airbnb

Airbnb connects hosts who have apartments or rooms to rent with travelers who need a place to stay. Today a household name, Founder Brian Chesky struggled in the beginning, begging venture capitalists to invest $150,000 to keep it afloat—in exchange for 10% of the company. One of those VCs walked out of a coffee shop meeting with Chesky, convinced he was a mad man with a losing idea. Oops!

A few things the Airbnb app does right:

- Powerful filters that make it easy to find the precise accommodation you want, down to details like whether the place has an iron to iron clothes or a desk to work from.

- Easy in-app communication so hosts and guests can coordinate directly from the app.

- Fully integrated payment system that includes the ability to pay for incidentals. For instance, if you lose the house keys and owe the landlord extra money for the copy they made, you can handle that exchange through the app.

Price: Paid as per booking.

Netflix

Netflix is a subscription-based video-on-demand app. It is the world’s foremost subscription Over the Top (OTT) media service, accessible on multiple devices, including mobile. Netflix constantly updates its huge inventory of films with the latest and most acclaimed movies and shows across many genres.

At the end of 2020, Netflix had over 204 million paying subscribers, and 47% of Americans prefer Netflix over any other video streaming service. Usership skyrocketed even more as the Covid-19 pandemic wore on, with many of us on lockdown and longing to escape into a world of cinema.

A few things the Netflix app does right:

- Suggestions based on the content users like have not only allowed Netflix to keep users engaged, but it’s led to a burgeoning of original TV shows produced by Netflix itself.

- Offline viewing lets users download shows and movies so they can view them later on the metro or anywhere else they don’t get data service. We’re getting used to this by now, but it used to be that we could only stream content using a live connection.

- Parental controls allows parents to easily control the content their kids download on a family plan, and it can all be done via the app.

Pricing: Paid subscription.

Amazon

One of the world’s largest multinational tech giants, the Amazon ecosystem offers digital streaming, cloud computing, e-commerce, and more. Always at the forefront of UX innovation, the Amazon app makes it easy to buy, review, and return products around the world.

A few things the Amazon app does right:

- Barcode scanner feature, which allows shoppers to scan a barcode for an item they find in a store and compare it to the price on Amazon.

- A high-tech, seamless returns process allows users to select products they wish to return and process those returns directly from the app. In certain parts of the world, customers can then bring the items they wish to return to a local retail partner. The partner scans a QR code from the app, receives the item, and takes care of all the return shipping.

- Buy Now button that lets users make a purchase with a single click, assuming they’ve already uploaded their credit card and address information.

Pricing: Free.

YouTube

YouTube is the world’s most popular video platform. It is a treasure trove of entertainment and original content, helping millions of creators shoot and share their work with the world.

A few things the YouTube app does right:

- Video chapters allow creators to break longer videos up into sections, that way viewers can jump to the “chapters” they want to view and skip past segments that don’t interest them.

- Easy-to-access caption buttons so viewers can see captions on any video.

- Subscribe button that allows users to subscribe to a favorite creator’s channel with one click. This means users will receive notifications each time that the creator posts a new video, thereby boosting engagement and growing the platform.

Pricing: Free, with the option to purchase an ad-free subscription.

Dropbox

Dropbox is a reliable and well-designed cloud storage app that functions well on multiple devices. It makes it easy to share files with teams or store important documents on the cloud for future access. You can even comment on documents you’ve shared with other people.

A few things the Dropbox app does right:

- Easy integration with other top apps and web service available, with zero compatibility issues.

- No file-size limit on uploads.

- Easy sharing features, allowing users to create secured links to documents they want to share with a handful of people.

Price: Free to download, with a paid version that includes additional benefits like extra storage.

Spotify

Spotify is one of the most popular apps in the music space. It has consistently upgraded its mobile app design, streaming quality, and music sharing capability. The app has an ad-supported free version, whereas Spotify premium membership removes ads and gives additional features.

A few things the Spotify app does right:

- Offline listening for premium members, allowing users to download the songs they like and listen without an internet connection (saying goodbye to iTunes).

- Playlist following and sharing allows users to share and discover new music.

- Made-for-you playlists, with the app’s algorithm sending you new music based on your preferences.

Price: Free, with paid subscriptions available for ad-free listening and additional features.

Launched in 2009 by Brian Acton and Jan Koum, and sold to Facebook for $19 billion in 2014, WhatsApp is popular around the world. It’s used to chat, make phone calls, and communicate seamlessly by using internet data to bypass international phone networks. It currently has more than 1.5 billion users worldwide.

A few things WhatsApp does right:

- End-to-end encryption helps keep users’ data safe.

- Voice messages with no time limit (unlike Facebook Messenger, which limits your messages to one minute).

- Pin-dropping that allows users to share their live location with friends.

Price: Free.

Honorable Mentions: Seamless and Pocket

Beyond our top ten, we wanted to mention two more popular apps that didn’t make the big mobile apps list but deserve a shoutout nonetheless for their superior UX and overall execution.

Seamless

Seamless, a food ordering app, lets users order food online through their smartphones. Seamless is part of GrubHub, where users can order meals from around 35,000 restaurants in more than 900 cities.

A few things the Seamless app does right:

- Offering tremendous variety from a wide range of restaurants.

- Simpler, more user-friendly ordering process compared to similar apps.

Price: Free.

Pocket helps users save and share videos, articles, and emails to their smartphones. The app learns what you like to read and recommends similar articles.

A few things the Pocket app does right:

- Highly readable interface for offline viewing.

- Computer narration, in case you’re occupied and want a Siri-like voice to read the content to you.

Price: Free.

Why Should a Business Invest In Mobile App Development

Mobile users are steadily increasing, which makes a mobile presence imperative for most businesses. Users love working with companies that make it easy to access their content and do the things they want to do directly from their smartphones and tablets.

The best mobile apps increase customer engagement by solving a problem and offering a powerful UX. They also provide a personalized channel to connect with a business, along with quick, easy access to customer support.

Digital transformation is shaping the future of every business that’s operating online, and missing out could spell disaster. The most popular apps, which we highlighted here, have leveraged technology to become successful around the world. Building a feature-rich application with the help of a skilled team of developers and designers can take your business to new heights.